Tokenomics, or token-economics, is defined as the economic incentive models (including distribution and rewards) created within a blockchain through the use of tokens or cryptocurrencies.

Typically, the purpose of a token within a dapp or a blockchain network is to incentivize a set of actions that lead to desired outcomes. These outcomes can include the usage of a product, the trading of goods and services, the sharing of information across a user’s network, or the validation of transactions.

The basic assumption is that users are more likely to engage in certain activities if they can be rewarded with tokens that hold some kind of monetary value.

These users might already be engaging in these activities for free or might have never considered these activities prior to the token incentive model existing.

With the exception of staking to validate transactions, you generally want to incentivize actions that your target users are already doing for free, or are at least familiar with. For example playing a game, borrowing from a lending protocol, providing liquidity, promoting something on social media, etc..

The more familiar the task, the more likely you will attract users who actually have a genuine interest in your product or service beyond the token incentive model.

Types of Tokenomic Models

While tokenomic models may differ between blockchains, there is a common set of models that have been adopted by blockchains like Bitcoin, Ethereum, Cardano and others.

Deflationary model

In a deflationary model, tokens have a maximum supply that is never increased, or make use of a ‘burn mechanism’ in order to decrease supply overtime by purchasing their own tokens and sending it to a one way wallet address.

You can think about this like share buybacks. Examples of cryptocurrencies that are deflationary include Bitcoin and ZEN. BNB is a token that is deflationary and also uses a buy and burn mechanism to decrease supply over time.

A deflationary model is the preferred model for founders that want to create a token that can be adopted as a store of value or a form of pristine collateral for borrowing and lending.

While limiting or reducing the supply of a token may increase its value in the short term, it often has the effect of reducing people’s willingness to spend it, as they assume the token will continue to appreciate in value and therefore do not wish to trade it for a potentially depreciating asset.

Inflationary model

In an inflationary model, tokens increase in supply over time based on rules established by an algorithm or through factors such as supply and demand. Examples of those using an inflationary model include ETH, SOL, ATOM

An Inflationary model is the preferred model for founders that wish to have their token be adopted as a transactable currency rather than a store of value.

The steady increase in supply discourages users from hoarding their tokens and instead encourages spending or putting the tokens to work in other ways like staking, investing, etc, in order to generate more tokens at a rate that beats the inflation rate.

This model more closely resembles that of fiat currencies, with the exception that levers for determining token inflation are written and executed by open source computer code, making it more transparent than central bank monetary policy.

Dual-Token Model

In the dual-token model, two tokens exist within a single blockchain. The most common variation of this is when one token serves as a store of value while the other has a utility function such as a medium of exchange.

Examples of those using a dual-token model: Terra (LUNA/UST), VeChain (VET/VTHO), and Ontology (ONT/ONG).

In an asset-backed model, a token is backed by underlying assets, such as fiat currencies, commodities or other cryptocurrencies. Examples of those using an asset-backed model, Tether (USDT) and Dai (DAI).

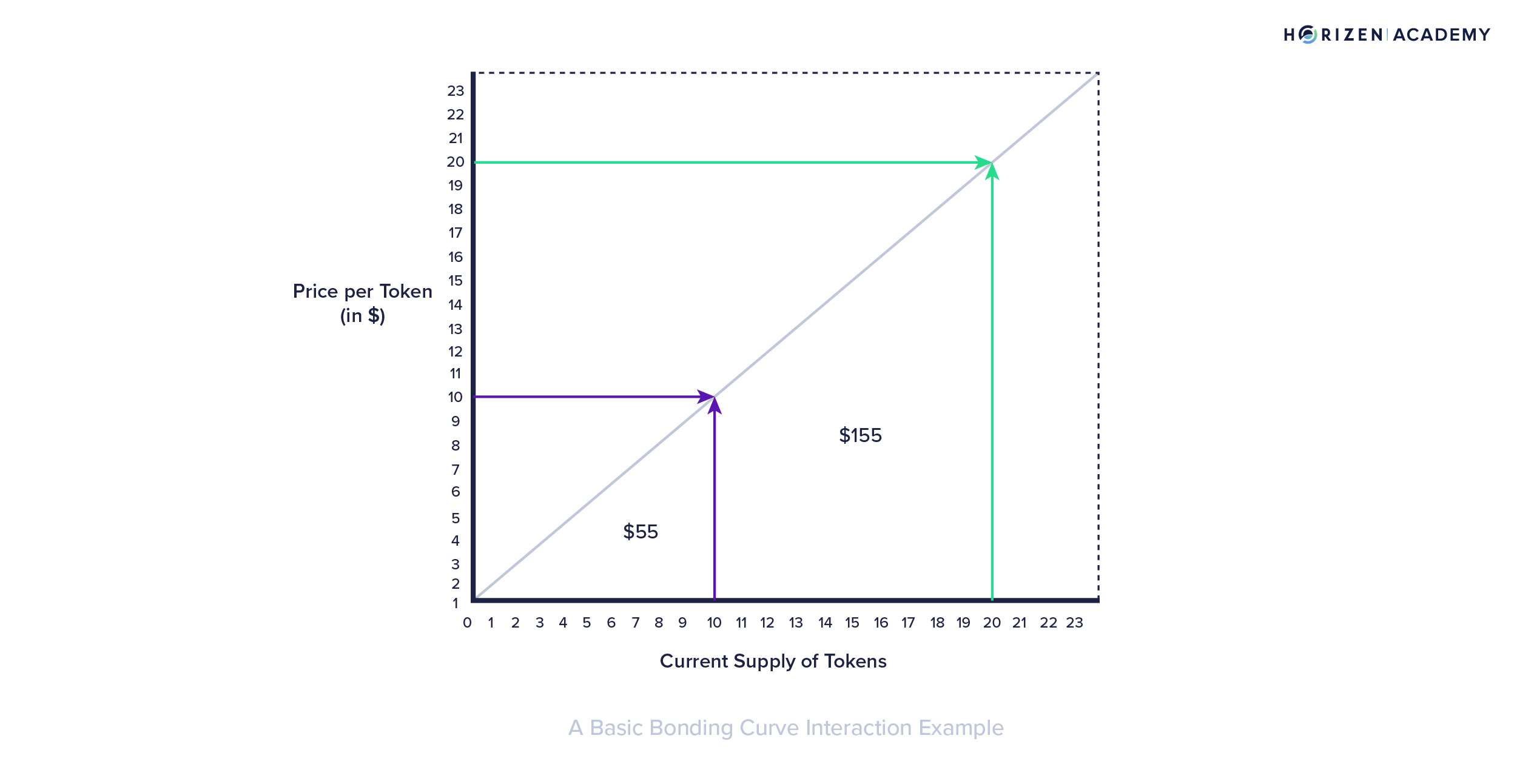

The bonding curve model uses a mathematical formula to establish a predictable relationship between a tokens price and supply.

With bonding curves, the price and supply of the token is set by the smart contract. As more people buy the token, it automatically mints additional tokens while incrementally increasing the price for the next buyer.

As people sell the token, the opposite occurs; the contract sets the price incrementally lower for the next seller while also reducing the supply.

The benefit of bonding curves is that they allow developers to establish more control and orderliness over how their token is valued in the market, as opposed to relying strictly on supply and demand, which can lead to higher levels of volatility that is detrimental to creating a relatively stable and usable digital currency.

Types of Actions

Before designing your tokenomics model, it’s important to first outline the type of actions you are trying to incentivize, as this will enable you to design a model that best fits your goals.

In our article Why Create a Token? we highlighted 3 main reasons to create a token:

-

Product/Network adoption

-

Fundraising

-

Transactable Currency

Each of these reasons comes with their own set of unique actions that we can incentivize through our tokenomics model.

For example, if you are creating a token to spur adoption of a product or network, your tokenomics should be designed in such a way that links usage of the token intrinsically with usage of the product. Then, reward users of the token with some combination of more tokens or other benefits tied to increase use of the product/network .

The best example of this is staking rewards that are earned by those who validate transactions on a proof of stake blockchain.

Here, the ‘product’ is the network, and one of the ways to use the network is to become a validator, which both requires tokens and rewards tokens.

Setting transaction fees that are denominated in your token is another way to link token usage with product usage. If your product is a web3 game, you can require users to purchase certain in-game NFTs that are priced on the token in order to play the game.

You can then reward users who win levels in the game or unlock certain achievements with newly minted tokens. This ensures that a dedicated subset of token holders will be using the token for the purpose of playing the game rather than just as a speculative asset.

Of course in order for this to be sustainable, the game must provide more entertainment value to the user than whatever monetary value they can extract from the tokens earned.

Token Distribution

Distribution is critical to design your tokenomics. This involves how you distribute the token to founders and team members, as well as how you make it more accessible for new users to purchase and trade it.

When it comes to team distribution, you need to identify how much of your tokens total supply should go towards key team members who will provide maximum value. This includes team members in engineering, business development and marketing.

For marketing, you might find it useful to allocate a portion of tokens to external partners who can give you access to their audience.

Distributing tokens to team members must be done slowly and based on a set schedule to ensure that they are properly incentivized to stick around and help you build or grow the project.

If too many tokens are granted to team members prior to the project achieving important milestones, the incentive to achieve those milestones could be minimized. It would also raise concerns amongst holders of the token that the team is not serious about building the project for the long term.

It’s also important that whatever distribution schedule you create is made transparent to the public and that the actual act of sending tokens to team members is done via smart contracts. This will allow holders of your tokens to have more trust in your team.

For distributing tokens to end users, the goal should be to make it as easy as possible for users to access and trade your token in order to maximize adoption.

You should focus on maximizing token distribution by providing liquidity on decentralized exchanges and by forming strategic partnerships with wallets, centralized exchanges and even vendors who may be willing to accept your token as a currency.

Design for Long-Term Sustainability Over Short-Term Growth

The general rule for building a sustainable Blockchain project and tokenomics model is to not issue more tokens in dollar terms than the dollars you earn as revenue.

This may not be achievable in the early days as you need to subsidize growth by rewarding more tokens to early adopters.

However, as your product grows in adoption, the total value of tokens rewarded for simply using the product should decrease to the point of being less than the revenue earned from the product, allowing you to continue rewarding users while maintaining a healthy profit margin.

Key Takeaways - Designing Your Tokenomics:

- Identify what type of action you want to incentivize

- Understand the various tokenomic models available to you

- Differentiate between a store of value and transactable currency use case

- Distribute tokens to founders and team members slowly and based on milestones in order to keep them incentivized to continue working on the project

- Devise way to maximize token distribution through liquidity provisioning as well as strategic partnerships with exchanges, wallets and vendors

- Design for long term sustainability over short-term growth